Would you like to give more and get more back?

Your securities and mutual funds will make a bigger difference to our work!

Donating securities or mutual funds, rather than cash, maybe your best way of giving. The Canada Revenue Agency does not apply capital gains tax on donations of publicly traded securities. Capital gains are the increase in the value of your securities over the price you paid at purchase.

When you sell your shares for cash, you’re responsible for the tax due on the gain, even if you plan to donate the proceeds from the sale. If you pay the tax out of those proceeds, there’s less money left to donate. Your charity receives a smaller donation and you have a smaller donation to claim for your charitable tax credit at the end of the year.

But when you donate your securities directly to any of our societies, those capital gains aren’t subject to tax. This means your gift to the Pontifical Mission Societies is a larger gift, and you’ll benefit from a tax receipt for the full value of your eligible securities or mutual funds.

You can donate securities to The Pontifical Mission Societies directly, for more information please call toll-free 1 (800) 897-8865 Or via Canada Helps securities services online*.

Donate Securities to

Propagation of the Faith

Donate Securities to

Saint Peter the Apostle

Donate Securities to

Holy Childhood Association

*When donating via Canada Helps, the value receipted will be the value at the end of the day when the security arrives at Canada Helps account, not the fair market value on the day the securities are donated.

Please also note if your security donation is submitted after December 15, there is no guarantee that your tax receipt will be issued for the current tax year.

Donating your securities via Canada Helps:

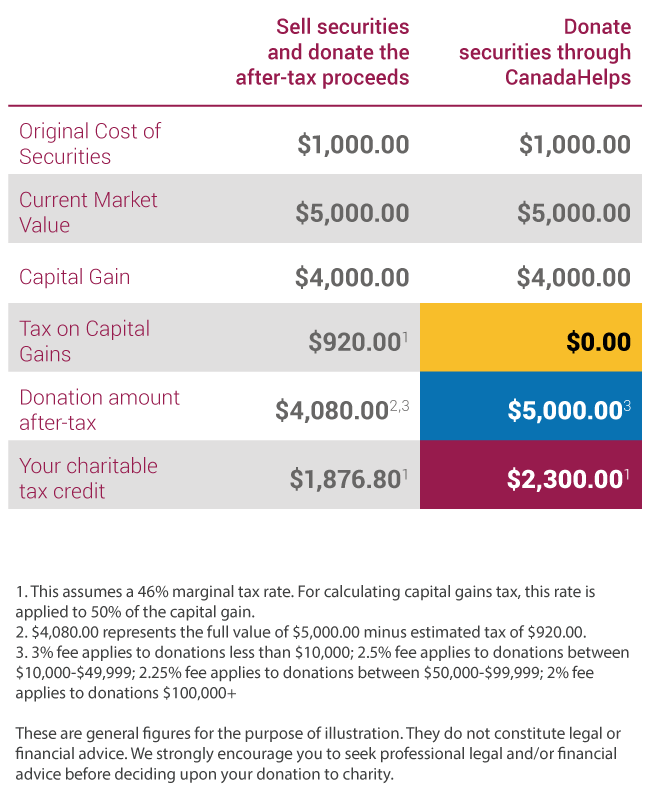

Let’s say you purchased common shares in ABC Company for a cost of $1,000.00. If the current market value of those shares has increased to $5,000.00, you would have a capital gain of $4,000.00.

If you sell those shares and donate the cash proceeds, you’ll owe tax on the capital gain. So, you set aside the taxes due from the proceeds, leaving you with less than the full cash value to donate and a tax receipt which reflects the smaller donation.

But when you donate the shares directly, you owe no capital gains tax and you’re able to donate the full value. So your charity gets a larger donation and you get a tax receipt which reflects your larger contribution.

Here are some approximate figures to illustrate:

In this illustration, you’re able to donate the full value of your securities to charity: $5,000.00. Your tax credit on that amount would be approximately $2,300.00, or about $920.00 more than if you had sold the shares and donated the proceeds as cash.